Test- FTSE 100 Kicks Off August on a High as BP and Senior Lead Market Momentum

$11

10 Oct 2025, 13:13

Unsplash.com

On Tuesday, Pfizer Inc. predicted that sales of its COVID-19 vaccination and treatment will decline more than expected in 2023, raising investor concerns about how much demand there will be for the drugs as governments reduce purchases and use up supplies.

According to Chief Executive Albert Bourla, Pfizer's COVID products should have a "transition year" in 2023 before perhaps returning to growth in 2024.

In 2022, Pfizer's total annual revenues surpassed $100 billion for the first time, thanks to sales of the antiviral Paxlovid and COVID-19 vaccination that totalled more than $56 billion. It anticipates sales of between $67 billion and $71 billion in 2023.

Pfizer's premarket share price dropped by around 2.8%. Through Monday's closing, the stock had lost 15% of its value this month.

According to Citi analyst Andrew Baum's research report, the firm is battling to break its dependency on COVID-19 medications.

Baum stated, "We see little here to modify our circumspect stance on Pfizer's ex-COVID business”.

Pfizer is also dealing with other challenges in addition to the drop in COVID-19-related income. The pharmaceutical has stated it estimates losing $17 billion in yearly sales between 2025 and 2030 as a result of the patent expirations for certain top-selling medications after 2025, including the cancer therapy Ibrance and the arthritis medication Xeljanz.

In order to strengthen its pipeline of potential new medications, Pfizer has turned to acquisitions like its $11.6 billion purchase of migraine pharmaceutical Biohaven and its $5.4 billion acquisition of Global Blood Therapeutics Inc. It introduced five new medicines last year and intends to release up to 14 more over the following 18 months, including an influenza mRNA vaccine and a vaccination for the respiratory syncytial virus (RSV).

Pfizer forecasts sales growth of 7% to 9% in 2023, excluding COVID-19 medications.

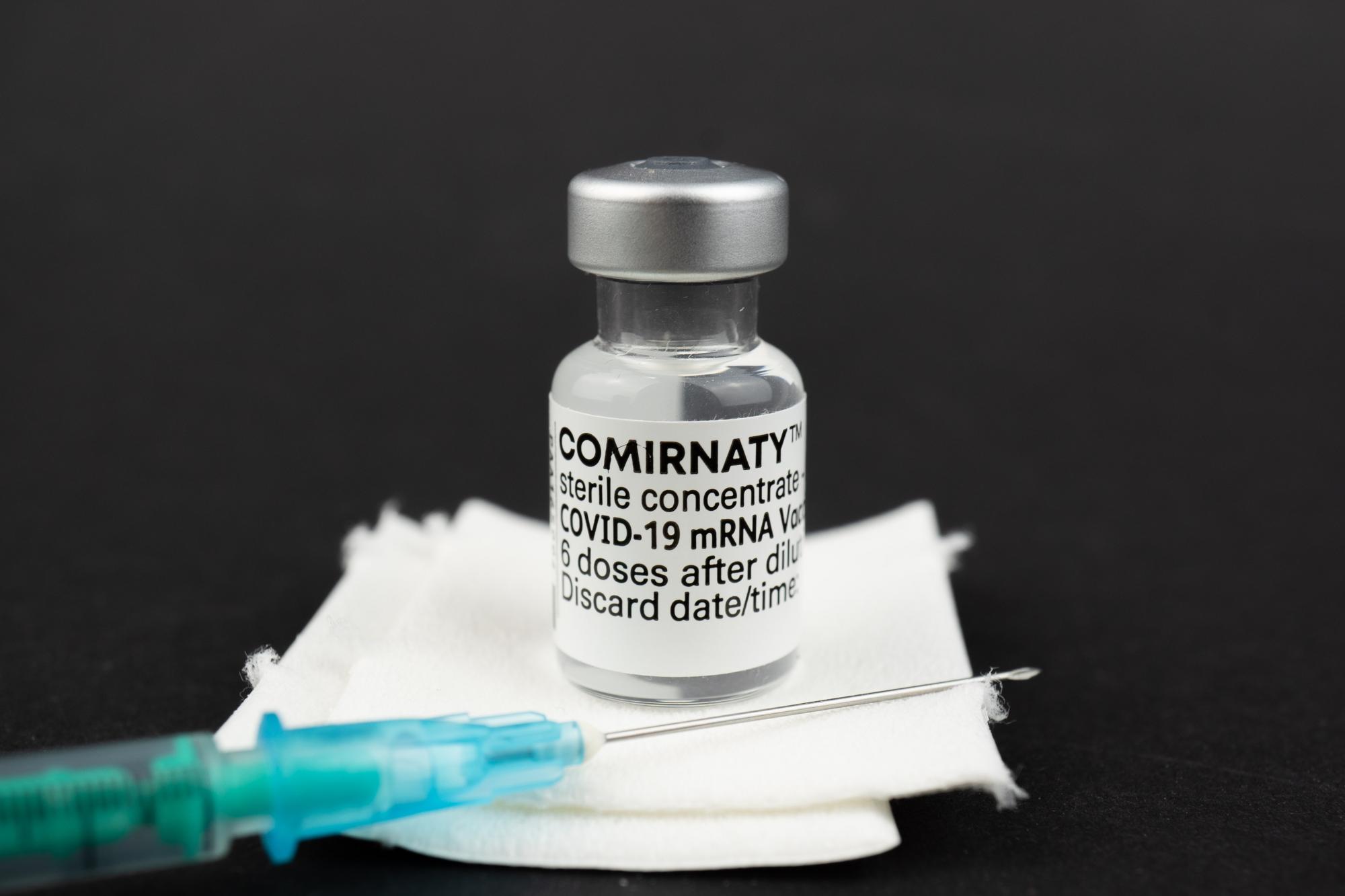

Bourla stated that rather than selling the injections directly to the government, the business intends to offer its vaccine Comirnaty through commercial channels in the United States in the second half of 2023. The business imagines that the cost of the COVID-19 vaccination in the US would almost treble with that change.

Analysts and investors have been seeking clarification on Paxlovid demand in China, where the medication is only covered by the nation's comprehensive healthcare insurance plan till the end of March.

Pfizer claimed that it does not currently foresee any sales from China beyond April 1; however, Bourla said that the firm considers offering Paxlovid in the private market after that.

(Investing.com, Reuters.com)