Test- FTSE 100 Kicks Off August on a High as BP and Senior Lead Market Momentum

$11

10 Oct 2025, 13:13

Unsplash.com

As investors processed conflicting inflation data from China and Japan on Wednesday, most Asian equities stayed inside a narrow range. At the same time, speculation over when the Federal Reserve may start reducing interest rates persisted.

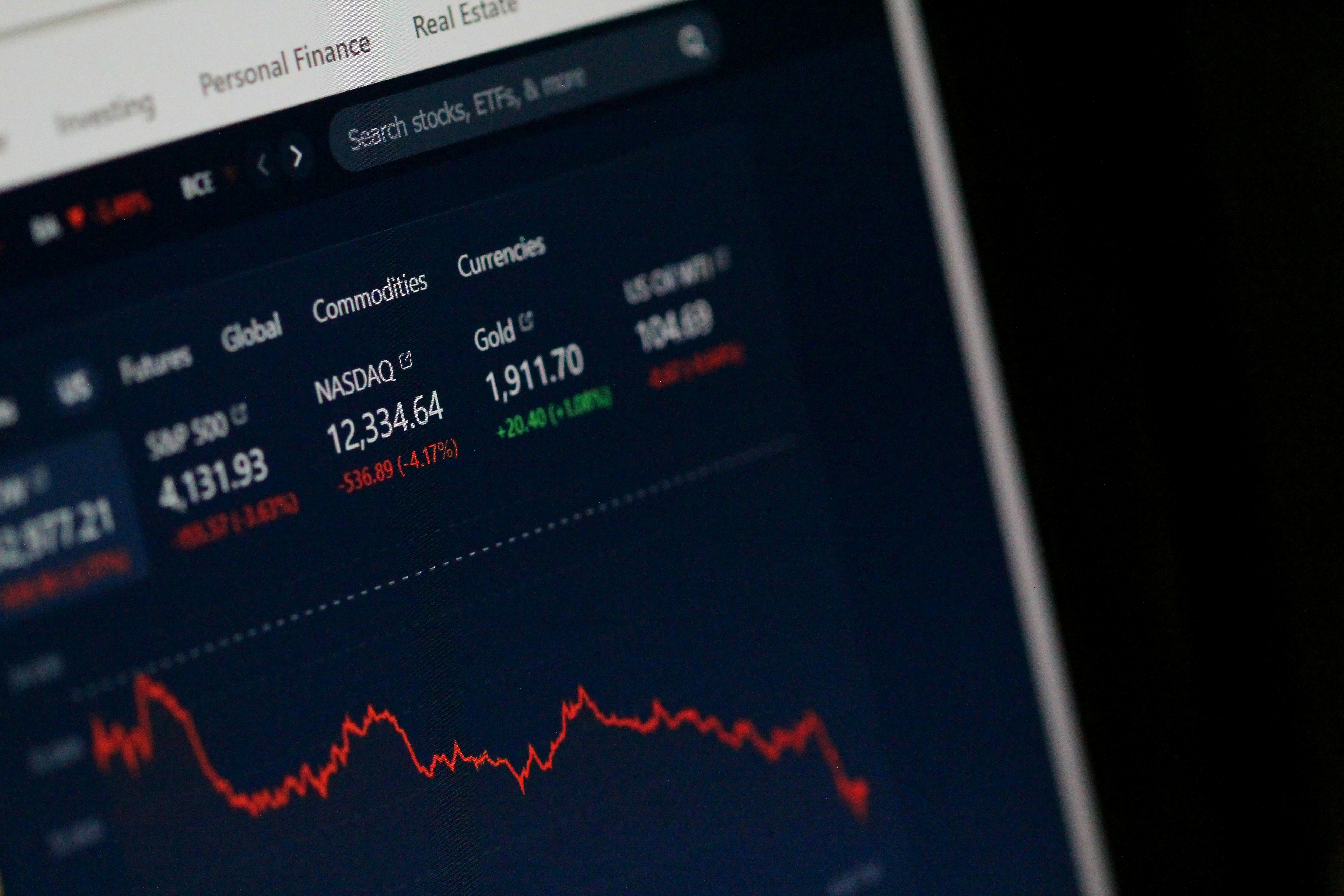

Wall Street, where increases in technology companies saw the S&P 500 and the NASDAQ Composite almost reach record highs, served as a lacklustre model for regional equities. However, Wall Street's rate of growth was decreasing.

In Asian trading, U.S. stock index futures remained unchanged as investors processed Fed Chair Jerome Powell's remarks. Powell acknowledged a slowdown in the economy but did not provide any specific dates for the central bank to start lowering interest rates. Traders were nevertheless observed keeping their bets on a September reduction.

Powell is scheduled to testify again on Wednesday. This week's important U.S. inflation figures are also of interest.

Foreign purchases helped to drive recent advances in the Japanese markets, which coincided with the yen's steep slide and investors' bets on a dovish outlook from the Bank of Japan.

On the other hand, June saw a modest increase in Japanese producer price index inflation, according to statistics released on Wednesday, bringing the year-over-year rate to 2.9%.

However, at 0.2%, month-over-month PPI inflation rose less than anticipated.

There were concerns about whether Japanese inflation may eventually force the BOJ to tighten policy further because the figure showed that although it was rising, it was still slow.

Inflation measured by the Chinese consumer price index decreased in June compared to the previous month as consumer spending declined due to ongoing worries about an economic recovery.

However, PPI inflation decreased at the slowest rate in sixteen months, suggesting that the ongoing government stimulus programmes were helping China's manufacturing.

Nevertheless, Wednesday's statistics indicated that China's general disinflationary trend persisted, which gave rise to little optimism about the nation. Fears of a trade war with the West have undermined optimism, and Chinese markets have been suffering severe losses in recent weeks.

(Sources: investing.com, reuters.com)