Test- FTSE 100 Kicks Off August on a High as BP and Senior Lead Market Momentum

$11

10 Oct 2025, 13:13

Unsplash.com

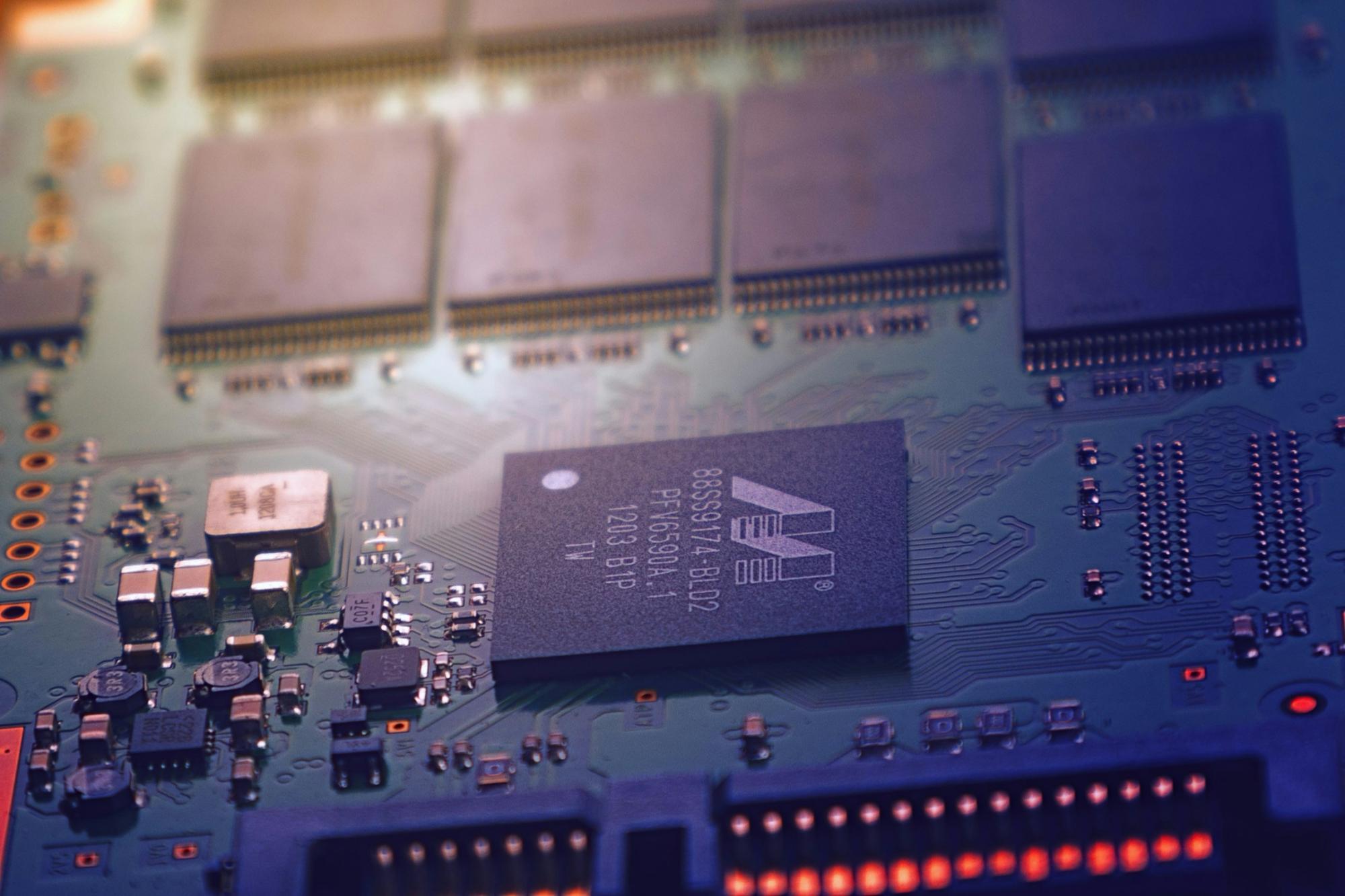

Goldman Sachs analysts have identified three European chip stocks that they feel might see a substantial favourable change in the upcoming years due to increased demand from artificial intelligence (AI) industries. The Q4 2023 earnings season has concluded.

Three Dutch semiconductor businesses, ASML, ASM International, and BE Semiconductor Industries, have the backing of a Wall Street titan.

Goldman is feeling upbeat about ASML because of several indicators that point to a robust demand for semiconductors, particularly from the AI industry.

They draw attention to consistent upward risks to 2025 demand projections, which are supported by Nvidia's projection of data centre expansion and the potential multi-billion dollar opportunity presented by sovereign AI.

Positive changes in the industry are also considered advantageous for the chipmaker, such as the anticipated rebound in investments in semiconductor equipment and the emphasis on advanced logic/memory applications.

The company's dominant position is further reinforced by ASML's remarks at the EU Tech conference on the expanding requirement for data collecting and the strong demand for its Immersion products. Goldman's optimistic view is reinforced by the knowledge that ASML's EUV exports for 2024 are already essentially reserved, and that any more orders will probably help 2025.

Analysts said that ASMI is in a great position mainly because of its considerably higher-than-expected order intake in the fourth quarter of 2023, which included orders for GAA pilot lines and strong demand from China.

They interpret ASMI's forecast that more than half of its Logic/Foundry orders in 2024 would come from GAA technology as an indication of the technology's increasing market momentum and acceptance.

A positive prognosis for semiconductor demand is further supported by the prediction that by 2027, almost 30% of all logic devices will have AI capabilities. Additionally, there will be a constant need for high bandwidth memory to enable AI applications until 2024.

The analysts emphasised a number of favourable aspects of BE Semiconductor Industries (BESI), such as the chipmaker's diversity with nine clients spread across different industries and geographical areas, which lowers the danger of customer concentration.

BESI's Hybrid Bonding tools for smartphones have a lot of promise, according to Goldman's staff, and the need for AI is only going to increase. Since this technology allows for more complicated data processing directly on devices, long-term shipment objectives should benefit from it.

(Sources: investing.com)