Test- FTSE 100 Kicks Off August on a High as BP and Senior Lead Market Momentum

$11

10 Oct 2025, 13:13

XTB.com

Investors started the week in heavy selling mode triggering a sharp sell off in global stocks on fears of a looming recession in the United States. A shock decline of 13% in the Japanese Nikkei during the asia trading session set the tone for what was to come across Europe and the US, where every major stock index including the FTSE 100, DAX 40 and Nasdaq 100 followed suit with their own sharp declines.

So what’s causing the global sell off?

A downturn in US macroeconomic sentiment over the past week has painted a picture of a material slowdown in the US economy. US non farm payrolls came in much lower than expected at 114,000 in July - significantly lower than the monthly average for the past year - with the June jobs data also being revised lower and the unemployment rate rising to 4.3%. The poor data came on the back of a disappointing earnings release from multiple major US stocks, especially semiconductors. The timing of the data release hardly helped either, as it came following a two-day meeting of the Fed which resulted in US interest rates remaining on hold at its 23-yr high rate of between 5.25% and 5.50%. Despite the markets now pricing in a rate cut in September's FOMC meeting, investors are feeling that the Fed has acted too slowly to curb a downturn in economic activity in the world's largest economy and as a result are pulling risk out of the markets.

Chart 1 - Nasdaq 100 has fallen more than 15% in the past 30 days (10th July to 5th August)

(Source: XTB)

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

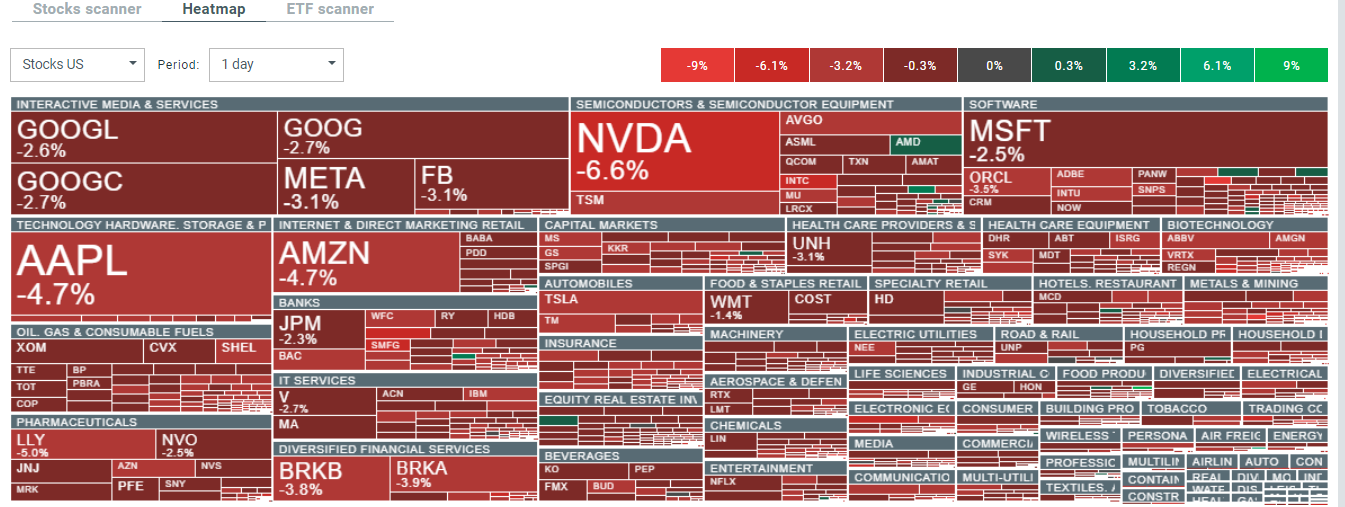

Chart 2 - XTBs stock heatmap shows that nearly all US stocks are in the red on Monday 5th August as investors pull funds out of Us stock markets

(Source: XTB)

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Are there more stock market declines to come?

U.S. market sentiment has certainly started the week poorly but improved after the release of July’s ISM data from the U.S., which the market took as evidence that a recession in the U.S. economy is not a foregone conclusion. ISM services data in June showed 48.8, but today's July reading shows a slight expansion at 51.4. Statements by the Fed's Goolsbee suggested that the Federal Reserve will not be in too much of a hurry to cut rates, 'overreacting' to the recent, noticeably weaker, but in Goolsbe's view 'not yet recessionary' data.

Such a 'hawkish' scenario is also made plausible by the strong reading of the services price sub-index, in today's ISM data (57 versus an expected drop to 55.1 after 56.3 in June). As a result, the ISM data is not unequivocally positive for the markets, so Wall Street's reaction after the report is admittedly upward, but the indexes are still far from erasing the declines.

Market turbulence extends to Crypto

Cryptocurrencies failed to escape the bloodbath in global stocks, with the value of Bitcoin slumping around 8% to trade back below $55,000 and Ethereum also losing more than 10% to trade back at $2,400. Cryptocurrencies are seen as high risk investments and when the markets are in a risk-off mood, Crypto typically gets hit hard and today is no different. What’s worth noting is that the speed of the sell off in Asia certainly sent ripples through the European session as traders arrived at their desks for the new week and this almost certainly exacerbated falls in high risk assets like Crypto.

Capitalising on Falling Markets with XTB

While the current market environment is challenging, it also presents opportunities for experienced investors. Strategies such as short selling and utilising CFDs on the XTB platform can be employed to take advantage from declining asset prices.

It is crucial to have a robust risk management plan in place when employing these strategies. Maintaining a diversified portfolio can help mitigate risks associated with these strategies.

Open an account with XTB today and take advantage of declining asset prices. Trade over 5800 instruments including CFDs on Forex, Indices, Commodities, Shares and ETFs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.